Microsoft Shows Strong Profit and Cash Flows, Making MSFT OTM Puts Worth Shorting

/Microsoft%20Logo%20on%20Building.jpg)

Microsoft Corp (MSFT) reported yesterday that it had strong profit growth and good free cash margins in its latest fiscal Q2 results ending Dec. 31. As a result, MSFT stock could be worth 10% more at $449 per share. It's also still an attractive short-put income play for existing investors and others.

Today MSFT stock is trading down slightly at $404.63 per share, off its prior close of $408.59 on Jan. 30, 2024.

I discussed Microsoft's earnings in my Jan. 28, 2024, Barchart article, “Microsoft Earnings This Week Could Highlight Its AI Efforts and Its Powerful Free Cash Flow.”

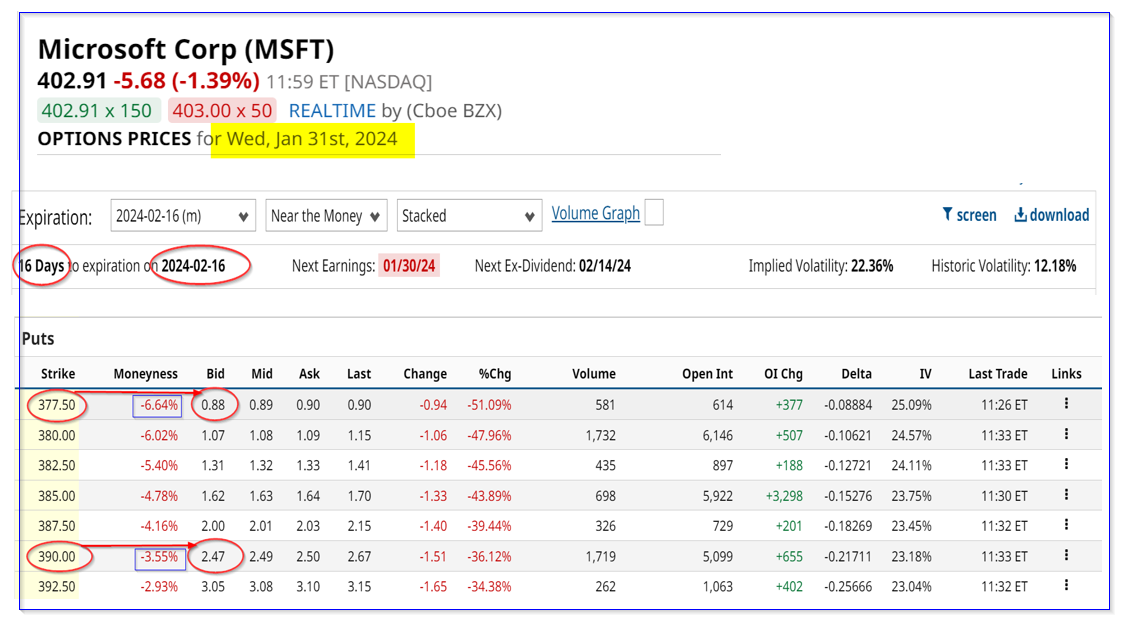

I also suggested shorting the $377.50 put option that expires on Feb. 16. That trade has already made those who followed it good money.

Microsoft's Earnings and FCF Were Strong

Microsoft said its revenues and earnings in its fiscal Q2 (ending Dec. 31, 2023) were strong. Sales came in at $62 billion, which was up 18% year-over-year. Its operating margin of $27 billion was high at 44%. However, last quarter it was slightly higher at $27.28 billion, which equals to a 48.3% operating margin.

Moreover, Microsoft generated free cash flow (FCF) this quarter of $9.1 billion vs. $4.9 billion a year ago. This was much lower than the $20.666 billion it generated last quarter. That was due to the timing of capex spending.

This is why it's important to use full-year FCF figures and last-12-month (LTM) FCF margin metrics. For example, according to data from Seeking Alpha, Microsoft generated $67.5 billion in FCF in the last 12 months ending Dec. 31. That works out to a healthy 30% of its $227.6 billion LTM sales.

Last quarter MSFT generated an LTM margin of just 28.9%, as I pointed out in my Jan. 12, 2024, Barchart article. So, this shows that Microsoft's FCF margin grew by 110 basis points this quarter on an LTM basis.

That makes me believe that the company's FCF margin could easily rise to 32% over the next year. We can use that to set a target price.

Target Price for MSFT Stock

For example, analysts now project sales for the year ending June 30, 2024, to reach $243.16 billion and $278.35 billion for the year ending June 2025. That means that in the next 12 months (NTM) the company could be on an average run-rate of $260.8 billion.

So, applying a 32% FCF margin to that number leads us to a forecast of $83.5 billion in NTM free cash flow. We can use that to project a stock price.

For example, we can use a 2.5% FCF yield metric, which is the stock's average figure. That is the same as multiplying FCF estimates by 40x (i.e., the inverse of 2.5% is 40). This gives us a market cap of $3,340 billion (i.e., $83.5 billion x 40 = $3,340 billion). This is 10% higher than its present market cap of $3.04 trillion.

In other words, MSFT stock could be worth at least $449.50 per share (i.e., 1.10 x $408.59, where it closed yesterday).

Moreover, using a 2.0% FCF yield metric (i.e., 50x multiple) gives a forecast of over $4 trillion (i.e., $50 x $83.5b = $4,175 billion), or 37.3% higher. That shows that its potential high target price could be as much as $561 per share.

Shorting OTM Puts for Income

Existing shareholders can make extra income by selling short out-of-the-money (OTM) puts, as I described above. In my last article, I recommended selling the $377.50 strike price put for $2.67 per contract for the period ending Feb. 16.

That worked out to an immediate yield of 0.71% or $267 for every put contract. That requires $37,750 in cash and/or margin to be secured with the investor's brokerage firm.

Today, those are trading for just 88 cents, so it has already produced a profit for the short sellers of those puts.

In addition, it's now possible to sell short the $390 strike price puts for Feb. 16 expiration at a $2.47 bid price. That produces $247 in income for the $39,000 secured, or 0.633%.

There are only 16 days until expiration. So if repeated every 2 weeks for a quarter the investor can potentially generate 5 to 6x this amount for the next 90 days. That works out to a quarterly yield of 3.17% (i.e., $1,235/$39,000) or 3.80% (i.e., $1,482/$39,000).

That is a good potential income for existing shareholders. For those who don't already own MSFT stock it could potentially be a good buy-in price, should the stock fall to $390.00 in the next two weeks.

Either way, MSFT stock still looks like it has a good upside over the next 12 months based on its latest results.

More Stock Market News from Barchart

- Will the Fed Signal a March Rate Cut Today?

- Stocks Slide as Tech Earnings Disappoint

- Meta Q4 Earnings Preview: Does Zuckerberg Have a Plan to Take META Stock Higher?

- Is Paramount Global’s Debt Getting the Way of a Sale?

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.